When will e correction coming for market shares?

-

Donald Ingram's Instablog

This one subject seems to be the main topic of financial conversation on everyone's mind these days - "Is this the end of the bear?" Short answer. No. To attempt to find an answer we must re-visit history, there are remarkable similarities between this bear and the Great Depression bear.

The Great Bear collapse top was in September 1929 and bottom in July 1932. Great Bear II topped in January 2000 and bottomed in October 2002. Resulting in a collapse of 89% and 40% respectfully (although the tech heavy NASDAQ lost over 80%). The 1930's saw a rally between 1932 and 1937 as the one between 2002 and 2007, with a secondary low in March 2003 as happened in March 1933. In 1937-38 there was financial panic as happened in 2007-08. The 1937-38 panic did not take out the 1932 low, however this time the 2002 low was taken out. Which gives the impression that the current bear has much more potential for the downside yet.

There is a prognosis from Elliott Wave guru, Robert Prechter and Kondratieff Wave cycle analyst, Ian Gordon who both predict a bottom of 1,000 - 1,300 for the Dow Jones Industrials. As to how deep this one will go is anyone's guess. I suspect that the next low will take out the recent March low by a fairly wide margin. Could it go as low as 1,000 Dow? I doubt it. However I have this nagging feeling that it may test that mark.

-

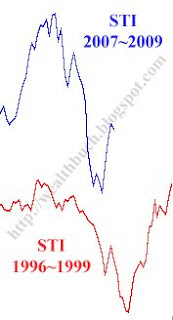

Suddenly had an inspiration to compare the performance of STI in 1996~1999 vs the current economic downturn. Below is a chart I took from Yahoo Finance, and edited in Photoshop to match them together.Do bear in mind that the timeframe was kept the same. No scaling or stretching of the charts were done; this picture is just a superposition of 2 different time periods.

It does look like we are repeating the same pattern.Will the pattern repeat again? Only time will tell. However, based on current sentiments, I do believe that it will repeat.