Financial Queries

-

Evening all..

Wanted to ask some financial gurus here some questions..sorry to bother ah.

My mom spoke to me last week on buying a condo as an investment. She said her savings put in bank is earning peanuts and said if she bought a condo, atleast rent it out can cover the monthly payment and after awhile, can sell our HDB house and move in or rent the HDB house out and move into the condo.

Her financial situation is as such. She has V amount of TOTAL savings. V consists of W, X, Y and Z. W=Normal bank account for day to day expenditure. Total amount is around $20k. X=Money for me and my brother's education. Total amount is around $80k. I have a diploma and my brother is having his O level this year. We are looking at this $80k as our tertiary funds. Y=Retirement funds for my mom. This is standing at $100k. And finally, Z=Investment funds which is currently in a fixed deposit in a local bank but is earning peanuts. Standing at slightly over $300k.

My mom is currently working in the govt sector with a pay of $4k+. She does not have much CPF funds left as she is using it to pay for the HDB house we live in. Reason much of it is depleted on the house is due to the fact that there is only one person contributing as she is a single parent. We live in a HDB house which is an Executive Mansionette and my mom has about 8-10 years more to pay for it. The things we are looking at is if we buy a condo, how much is bank interest p.a.? I've checked with DBS and it's 3.25% and offers a 30 year loan period. My mom is in the early 50s so will the bank give us a 30 years loan? Or will it be something lesser like 15 years? We will not move into the condo anytime soon as my mom plans to rent it out to FT. The cost of a condo we're looking at e.g LakeShore which is a new condo at Jurong West costs around $750-$800k for a 2 bedroom condo. If my mom decides to pay $300k upfront, how long a loan period will we be given by the bank? The main reason my mom is planning this investment is because in the long run she wants to leave 1 house for me and 1 house for my brother so that in the case the unmentionable happens(touchwood), we will not be at a lost. The montly payment comes to $2868/mth adding in the 3.25% interest p.a. over a period of 15 years including a $300k payment upfront. Cost of condo estimated at $800k. This $2868 does not includes the montly maintanence fees such as securtity and stuffs needed to pay to the management of the condo. We would like to know how much is the market rate for renting such a condo.

Another thing is, I understand in the HDB ruling, if one of the owners passes away, the other does not need to pay for the house. However this rule was like 10 years ago when we bought the HDB house so we're unsure does this rule still stays should we purchase a new house. My mom is covered but now she's diabetic so she will not be covered if she buys a new house. Do condos have such policy or it's like no matter what happen still need to pay the cash? My mom also doesn't wants to let her colleagues know of this so is it possible my mom purchases the condo under my name? However I've just completed my Diploma and currently awaiting National Service. So even if my mom pays the monthly payment, will the bank not approve as I do not have a montly income.

I'm sorry to bother everyone with so much question and this wall of text. We're looking at not engaging an agent yet as we do not want to be committed to one and force us into buying something we're not interested or not give us full details on how and what are we covered for.

The last and final question would be: Is it a feasible investment? Will it work out for us in the long run as my mom has about 10 years left to work. Or are we better of leaving the money in the bank?

Thanks everyone for your time.

-

interesting

-

Who is actually paying for the condo? Your mother alone is paying? Or whole family are paying for it? Cause a 4k+ per month is not enough to afford a condo. If your family income is more than 10k per month. Should be able to maintain the condo with ease.

-

Property is expected to slow down till around 2010

-

Originally posted by eagle:

Property is expected to slow down till around 2010

Really?

HDB, condo, landed.

You see a significant correction coming for all classes?

Any good sources of reports / info on this?

-

Originally posted by charlize:

Really?

HDB, condo, landed.

You see a significant correction coming for all classes?

Any good sources of reports / info on this?

Hmmm.. Think of recent economy... It's sooner or later property will be going down...

-

But a lot of people say sg property prices will not drop too much.

Maybe only 5 - 10% and then will pick up when the IR opens in 2009.

Rationale being sg is always land scarce and population is targetted to increase to 6 million in the next 5-10 years.

I personally think prices will collapse and correct violently.

What's your view on it?

-

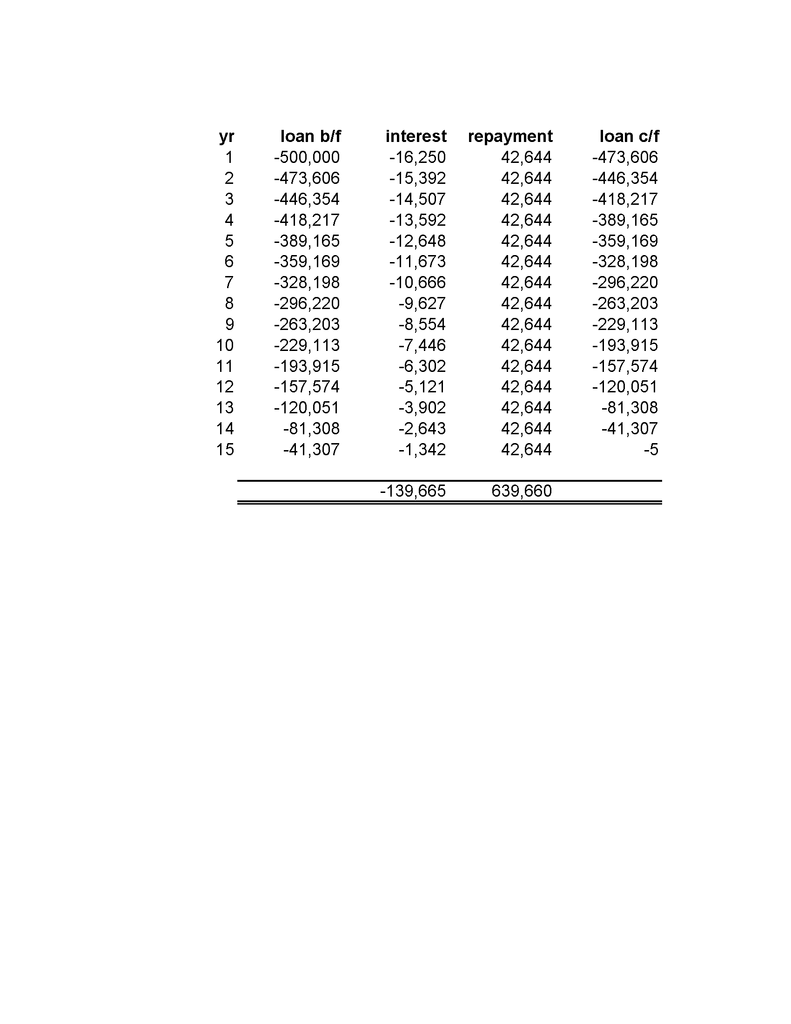

There is something wrong with your calculation of interest for the $500,000 loan. When they mean 3.25% p.a., it does not mean you only pay 3.25% interest for the 15years.

Your calculation of interest: $500,000 x 3.25% = $16,250 (it's wrong).

You repayment should be in the region of $42,644 per year, I didn't use continous compounded interest, only yearly compounding.

You also should be wary of property tax, which will be on a non owner occupied basis, it could come up to $1,800 a year in property tax.

-

Your loan repayment schedule should look something like this.

-

Speaking of property prices, is there anywhere we can find out how low property prices were during the SARS period or during previous recession years?

For HDB resale, condo, landed property etc.

If we can estimate the low, then we can probably use it as a guage for how low it might drop in the coming year or so and act accordingly.

-

If you get rentals for the condo, say on a worse case scenario $2,500 a month, your mom will need to fork out another $1,000 from her salary of $4,000.

Is her retirement funds liquid (easily cash out)?

How stable is her current job? Any chance for higher salary?

-

I guess you still have to find a reliable housing agent to explain to your about the details on getting a condo as an investment.

The agents would have to know your needs and your financial condition to recommend you a appropriate condo.

You may consider renting some of your room from your existing HDB flat to get some passive income.

As for the condo, try to go around to the new condo open house every weekend.

Do some research so that you can gather useful information when you can ask the right questions.

-

Originally posted by maurizio13:

If you get rentals for the condo, say on a worse case scenario $2,500 a month, your mom will need to fork out another $1,000 from her salary of $4,000.

Is her retirement funds liquid (easily cash out)?

How stable is her current job? Any chance for higher salary?

Job is stable, although pay is not much, every 6 months there is bonus. For the higher salary part, I'm not sure. Her retirement funds is in a fixed deposit with the bank, something that she renews every 2 years.

Who is actually paying for the condo? Your mother alone is paying? Or whole family are paying for it? Cause a 4k+ per month is not enough to afford a condo. If your family income is more than 10k per month. Should be able to maintain the condo with ease.

She will pay for the upfront and the monthly payment will be covered by rental as we do not plan to stay in the condo, renting it out.

-

15 years is a long time.

can shorten it if you support the house on top of the rental.

pay less interest for the loan too.

than you can get to enjoy the rent money it generates.

-

Originally posted by Medicated Oil:

I guess you still have to find a reliable housing agent to explain to your about the details on getting a condo as an investment.

The agents would have to know your needs and your financial condition to recommend you a appropriate condo.

You may consider renting some of your room from your existing HDB flat to get some passive income.

As for the condo, try to go around to the new condo open house every weekend.

Do some research so that you can gather useful information when you can ask the right questions.

Alright thanks bro.

Yeah we have thought of renting out rooms in our current house too.

-

now is not the best time to get into the property market.

the price of properties is expected to take a further plunge in the next few months to come.

wait a while longer, if you want to invest in properties.

-

wait a few months? or a few years?

-

Wait for Warren buffet to open his mouth

-

Originally posted by maurizio13:

There is something wrong with your calculation of interest for the $500,000 loan. When they mean 3.25% p.a., it does not mean you only pay 3.25% interest for the 15years.

Your calculation of interest: $500,000 x 3.25% = $16,250 (it's wrong).

You repayment should be in the region of $42,644 per year, I didn't use continous compounded interest, only yearly compounding.

You also should be wary of property tax, which will be on a non owner occupied basis, it could come up to $1,800 a year in property tax.

Bro if you free..can help me come up with how much my mom pay every month including principle, interest and tax based on $500k and interest of 3.25% for 15 years? So sorry to disturb you ah. Thanks in advance:)

-

Originally posted by TDurden:

Bro if you free..can help me come up with how much my mom pay every month including principle, interest and tax based on $500k and interest of 3.25% for 15 years? So sorry to disturb you ah. Thanks in advance:)

42644 divide by 12?

3553

-

Hi TDurden,

I'm impressed that your mother managed to set aside funds for various purposes single-handedly. She must have been very frugal.

Let's take a look at your family's current financial situation:

W = $20K. This is the emergency fund that she has set aside, which is 3-6 months' of your family expenses.

X = $80K, for education funds. She might want to consider setting more aside since it's for you and your brother. In any case, should one of you decide to go for overseas university, the amount required will be more.

Y = $100K for her retirement funds. Assuming your mother retires at age 62, and lives to the average life expectancy for females which is 85, she needs money to last her for the next 20-25 years. $100K/25 = $4,000/yr which is insufficient.

Z = $300K bank savings/fixed deposit, not investment funds. If you factor in inflation of 3%, your mother is losing $6,000/yr, assuming fixed deposit interest rate is 1%.

Your mother should seriously think about how to maximise the use of this sum of money. Property investments are definitely favourable. However, considering the large amount of monthly cash repayment since your mother's CPF is depleted, property investment might not be so viable for your family at this point in time.

The monthly rental could be from $2,500 - $3,000. It depends very much on demand and supply.

You mentioned that the main reason your mother is planning this investment is because in the long run she wants to leave something for you and your brother so that in the case the unmentionable happens, you will not be at a lost. If that is the case, there is actually no necessity to look at property investments. There are other financial instruments which can take care of her concern.

Finally, it is unwise to leave all your money in the bank which is earning interests lower than inflation rate. Setting aside 3-6 months' of emergency funds, which what your mother has already done, is good enough. She should look at ways to make the rest of the money work harder for her, rather than she working so hard for money.

-

Well well isn't all the recent financial turmoils caused by 1 word. Greed?

-

Go for land banking if you dont need much liquidity and for long term purposes..

-

Originally posted by Sgwealthmanager:

Hi TDurden,

I'm impressed that your mother managed to set aside funds for various purposes single-handedly. She must have been very frugal.

Let's take a look at your family's current financial situation:

W = $20K. This is the emergency fund that she has set aside, which is 3-6 months' of your family expenses.

X = $80K, for education funds. She might want to consider setting more aside since it's for you and your brother. In any case, should one of you decide to go for overseas university, the amount required will be more.

Y = $100K for her retirement funds. Assuming your mother retires at age 62, and lives to the average life expectancy for females which is 85, she needs money to last her for the next 20-25 years. $100K/25 = $4,000/yr which is insufficient.

Z = $300K bank savings/fixed deposit, not investment funds. If you factor in inflation of 3%, your mother is losing $6,000/yr, assuming fixed deposit interest rate is 1%.

Your mother should seriously think about how to maximise the use of this sum of money. Property investments are definitely favourable. However, considering the large amount of monthly cash repayment since your mother's CPF is depleted, property investment might not be so viable for your family at this point in time.

The monthly rental could be from $2,500 - $3,000. It depends very much on demand and supply.

You mentioned that the main reason your mother is planning this investment is because in the long run she wants to leave something for you and your brother so that in the case the unmentionable happens, you will not be at a lost. If that is the case, there is actually no necessity to look at property investments. There are other financial instruments which can take care of her concern.

Finally, it is unwise to leave all your money in the bank which is earning interests lower than inflation rate. Setting aside 3-6 months' of emergency funds, which what your mother has already done, is good enough. She should look at ways to make the rest of the money work harder for her, rather than she working so hard for money.

Other ways to make the rest of the money work harder meaning? You left me with alot of thoughts to chew on man, it's looking bad. Can you explain to me more on these other ways? Shares & stock should be no, my mom sure don't want her hard earn money to just burn.

Go for land banking if you dont need much liquidity and for long term purposes..

Hi can you care to explain to me more on this? Thanks.

-

Originally posted by TDurden:

Other ways to make the rest of the money work harder meaning? You left me with alot of thoughts to chew on man, it's looking bad. Can you explain to me more on these other ways? Shares & stock should be no, my mom sure don't want her hard earn money to just burn.

Go for land banking if you dont need much liquidity and for long term purposes..

Hi can you care to explain to me more on this? Thanks.

Not really a pro on this so I might be wrong. Perhaps can google or wikipedia what land banking is all about.

Nevertheless, the concept of land banking is to purchase a piece of undeveloped/raw land that is strategically located near the boundaries of a potentially expanding city. Undeveloped land is relatively cheaper and over years, with development and the expansion of the city boundaries to include your land, the value of your land would have escalated. So basically you pump in 50k for a land, and over 25 years perhaps, you can sell it for 100 or 150k? or more? Depends but generally the idea is there. Heard of stories whereby old grandpas and grandmas, manage to sell their kampung land for million of dollars? Basically thats the same idea. However, in SG there's no more or not much raw land. But there are international companies here which you can do land banking with such as Walton International, Profitable Plots etc..

The risks are relatively quite low the way I look at it. Perhaps you may want to research more. I'm no expert on this like I said. =)

Another alternative perhaps is to go for Islamic banking? Because of compliance with the syariah law, I heard it's hardly or not much affected by the ongoing economic situations. Instead of fixed interests, it is based on profit sharing.

Just some suggestions =)